How Scallop Built and Scaled Its Neo-banking App Using Ceffu’s Custody Solutions

On-chain banking app Scallop engaged Ceffu to build the foundation of its banking solution on top of our scalable custody infrastructure at the onset of the company’s early journey.

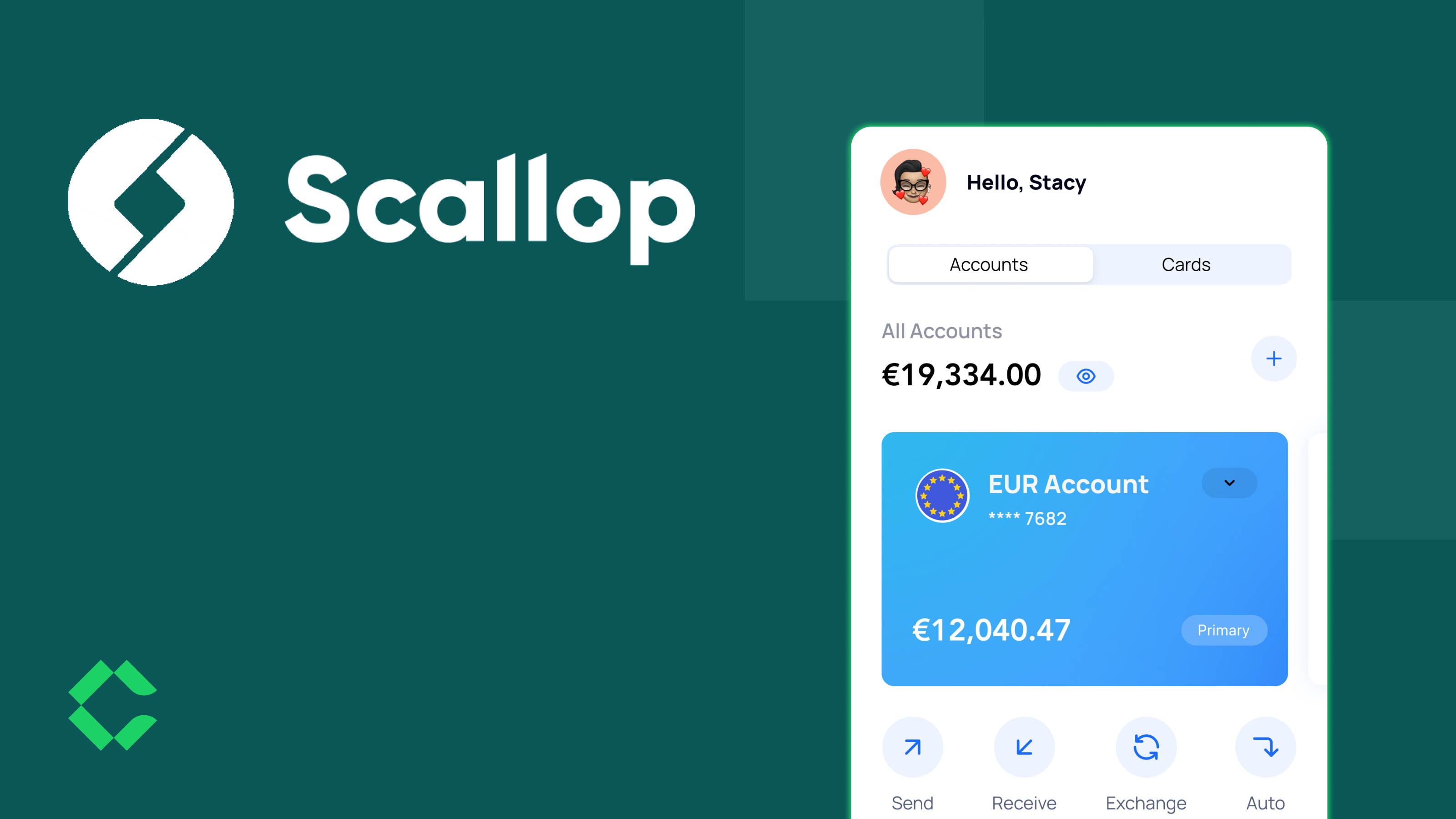

In addition to securing its treasury as well as the assets of its community on our enterprise-grade cold storage solution, Scallop needed a partner that would allow its retail and institutional users to create “virtual cards” (wallets) as needed to deposit fiat as well as buy and sell cryptocurrencies instantly.

Our B2B2C solution addressed the young tech startup’s mission of building the next super-app combining traditional banking and digital asset services from its inception through the official release of its application and ongoing user growth.

Prioritizing security with enterprise-grade cold storage

Before considering its scalability, it was paramount to the Scallop team that all assets be stored with the highest standards of security in place. Our insured Qualified Wallet solution gave Scallop the confidence it needed to focus on building its operations knowing all assets deposited are kept in 100% cold, on-chain wallets with segregated account and wallet systems. This type of infrastructure ensures that client assets are never commingled with other assets and provides full visibility that the only movements going in and out of those wallets belong to their respective owner.

Qualified Wallets are also powered by multi-party computation (MPC) technology, a cryptographic process that splits a client’s private key into multiple key shares that are stored on hardware devices and distributed across separate geographic locations. This industry-leading technology optimizes account security by eliminating any single point of failure, should one of the key shares be compromised.

Empowering Scallop users with full flexibility to create and manage crypto wallets as needed

Ceffu’s full suite of custody solutions allowed Scallop to entrust the security of its assets as well as that of its users with Qualified Wallet, while also building its entire infrastructure on top of our Prime Wallet solution, a hybrid of hot wallet and cold storage with network-agnostic withdrawal solutions.

Powered by our OpenAPI function, Prime Wallet allows institutional clients to integrate a simple and robust RESTful API with their own applications. In the case of Scallop, the company can offer its users the ability to create multiple “virtual cards” (recorded as sub-account wallets in the backend) to manage their digital assets. Scallop also pairs these virtual cards with physical cards to cater to various user preferences when it comes to managing and using their funds.

Bridging Scallop’s users to the world’s most liquid spot market

With spot trading fully integrated into our Prime Wallet solution, Scallop and its users have a direct gateway to the world’s deepest liquidity on the Binance spot market, which accounts for more than 60% of global spot liquidity. This integration provides Scallop users with the power to buy and sell cryptocurrencies in a highly liquid market with instantaneous transactions, while also managing their own funds as they would with a traditional bank, all in one neo-banking app powered by Ceffu’s technology.

"Prime Wallet has been phenomenal for us. For smaller tech companies like ours that are scaling fast, it’s really important to have the right infrastructure that combines security with flexibility for our users, while also having access to those solutions at competitive prices. No one on the market beats Ceffu in that regard." - Raj Bagadi, Founder & CEO at Scallop

With a mission of bringing to market cutting-edge financial products to millions of users across the UK and Europe, Scallop was able to officially release its powerful application through Ceffu’s full-suite of custody solutions to help retail and institutional customers manage their finances securely and efficiently.

-

About Scallop

Scallop Chain is a Byzantine fault tolerance blockchain with a core KYC & AML module included in the consensus mechanism at a protocol level. Its regulated, licensed interoperable infrastructure provides a suite of banking products built to empower millions of retail & business customers worldwide.

For more information, visit www.scallopx.com