Exploring the Premise of Central Bank Digital Currencies

The financial landscape is currently undergoing a momentous transformation with the emergence of numerous innovations that are redefining how individuals and institutions are interacting with one another. One such relatively recent innovation, emerging in conjunction with the popularization and widespread adoption of cryptocurrencies, is that of central bank digital currencies (CBDCs).

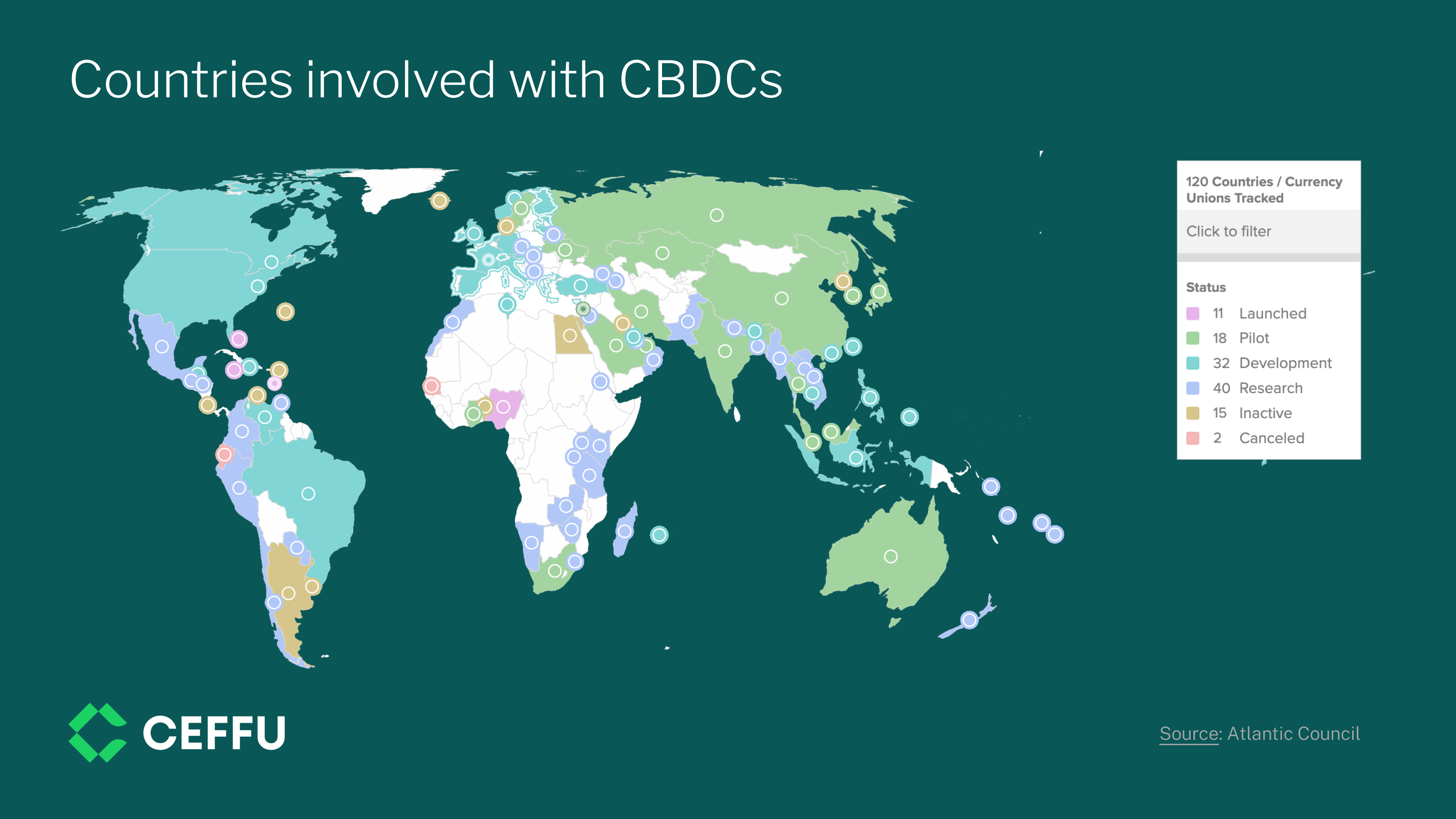

CBDCs are issued by a central authority and are designed to function as a digital version of fiat currency. Their concept has gained significant attention in recent years, with several countries exploring the potential launch of their own CBDCs. China, for instance, has already launched a digital version of its yuan currency, while other countries including the United States, Thailand, and the United Kingdom are actively exploring the possibility of launching their own CBDCs. These digital representations of fiat currency are expected to revolutionize the way people perceive and engage with money.

In this article, we delve into the historical context of CBDCs, examine their potential advantages and drawbacks, and discuss how they may intersect with the institutional custody space.

Understanding central bank digital currencies

Central bank digital currencies can be defined as digital forms of a nation's fiat currency that leverages blockchain or distributed ledger technology to facilitate secure and efficient transactions. The idea of CBDCs is very much linked to the rise in popularity of cryptocurrencies, whose decentralized nature and the potential they demonstrated for seamless, cross-border transactions sparked the interest of central banks worldwide.

Central banks began to recognize the need for a digital currency that could provide the benefits of transparency, security, and efficiency while remaining under their control and regulatory oversight. The concept of CBDCs started to take shape as a response to the challenges posed by cryptocurrencies and the growing demand for digital payment systems.

The landscape of CBDCs has been fairly dynamic with new developments taking place across the world. To put them into context, in May 2020, 35 countries were publicly considering implementing CBDCs. As of May 2023, over 100 countries are in various stages of implementation according to the Atlantic Council’s CBDC tracker.

What advantages do CBDCs offer?

Enhanced efficiency and security

Central bank digital currencies have the potential to streamline financial transactions, reducing costs and settlement times. The use of blockchain technology ensures transparency, immutability, and robust security, protecting against fraud and unauthorized access.

Financial inclusion and accessibility

CBDCs have the power to provide financial services to unbanked and underbanked populations, allowing for greater inclusion in the formal economy. By leveraging digital wallets and mobile devices, individuals can access banking services and participate in the financial system more easily.

Improved monetary policy and economic stability

Central banks can leverage CBDCs to enhance their monetary policy tools. Real-time data collection and increased transparency enable more accurate decision-making, leading to better management of economic cycles and increased stability.

Drawbacks from implementing CBDCs

Privacy and surveillance concerns

The digital nature of CBDCs raises concerns about privacy and surveillance. Striking the right balance between preserving individual privacy and ensuring compliance with anti-money laundering and counter-terrorism financing regulations is a delicate challenge.

Technological challenges

Implementing CBDCs requires robust technological infrastructure. Scalability, network security, and interoperability are essential considerations. CBDCs will need to be interoperable with existing financial systems to be widely adopted.Safeguarding against cybersecurity risks and ensuring resilience against hacking and fraud are critical in maintaining trust in the system.

Transition and adoption challenges

Transitioning to a digital currency system involves educating the public, fostering acceptance, and upgrading existing financial infrastructure. Collaborative efforts among central banks, financial institutions, and technology providers are essential to ensure a smooth transition.

Opportunities that lie ahead

Much like more “traditional” digital assets, institutional custodians can play a vital role in the development of the CBDC ecosystem by offering specialized custody services. As custodians of institutional investors' funds, they offer expertise in secure storage, regulatory compliance, and risk management, thereby enhancing the accessibility and security of central bank digital currencies and facilitating their seamless integration.

Numerous countries have already launched or announced plans for their own central bank digital currency. Data from the Atlantic Council suggests that over 20 countries have taken or will take significant steps towards piloting a CBDC in 2023, with Australia, Thailand, Brazil, India, South Korea and Russia having shown strong interest in continuing or beginning pilot testing. The European Central Bank has also hinted at a digital euro project that would ensure free access to a simple, safe and trusted means of digital payment for citizens across Europe.

With a market gradually up-trending and a digital asset economy continuously growing its footprint around the world, from both a user adoption and regulatory guidance perspective, 2023 is set to be a turning point for CBDCs and cryptocurrencies as a whole.